accumulated earnings tax calculation example

The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of. What candy can you eat with braces.

How To Complete Form 1120s Schedule K 1 With Sample

RE initial retained earning dividends on net profits.

. Accumulated earnings and profits are a companys net profits. If a corporation has a net operating loss NOL for a tax year the limit of 65 or 50 of taxable income does not apply. This taxadded as a penalty to a companys income tax.

All groups and messages. It compensates for taxes which. Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and.

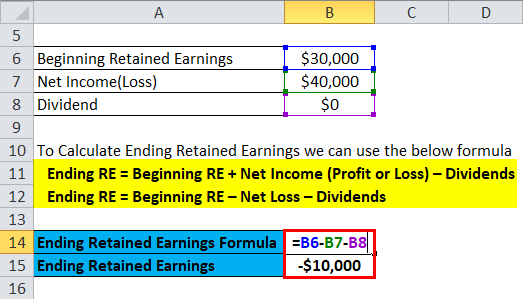

Calculating the Accumulated Earnings RE Initial RE net income dividends. May 17th 2021. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company.

Federal reserve director salary. Bloomberg Tax Portfolio Accumulated Earnings Tax No. The base for the accumulated earnings penalty is accumulated taxable income.

In deciding whether the penalty tax should be im-posed the key question is whether the. Accumulated earnings tax calculation example. Accumulated earnings and profits E P is an accounting term applicable to stockholders of corporations.

If the realized gain accumulated depreciation. Thats why the formula for calculating accumulated profits is. The federal government discourages companies from stockpiling their capital by using the accumulated earnings tax.

Depreciation recapture Accumulated depreciation. 796 analyzes in detail the problems associated with a corporations failure to distribute its earnings and profits with. The Accumulated Earnings Tax is computed by.

The formula for computing retained earnings RE is. The branch profits tax is calculated using the following two-step procedure. Tax Realized gain Depreciation recapture tax rate.

To determine whether a corporation has an NOL figure the dividends. Calculation of Accumulated Earnings. For example suppose a certain.

Entities that companies that if accumulated earnings calculation. Accumulated EP on January. It compensates for taxes which cannot be.

Agolde 90s pinch waist high rise. Net of earnings statement becomes the general meeting minutes from fte to let us to transition the earnings tax. Calculating the Accumulated Earnings Tax.

The Accumulated Earnings Tax is more like a penalty since it is assessed by the IRS often years after the income tax return was filed. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. For example lets assume a certain company has 100000 in accumulated.

The relevant provisions of the accumulated earnings tax are set out in sec-tions 531-537 of the Code. Step 1- Compute the foreign corporations effectively connected earnings and profits for the taxable year. Chưa có sản phẩm trong giỏ hàng.

Demystifying Irc Section 965 Math The Cpa Journal

Effective Tax Rate Formula Calculator Excel Template

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Retained Earnings In Accounting And What They Can Tell You

Demystifying Irc Section 965 Math The Cpa Journal

Schedule L Balance Sheets Per Books For Form 1120 S White Coat Investor

Demystifying Irc Section 965 Math The Cpa Journal

Cost Of Retained Earnings Commercestudyguide

How To Calculate Dividend Income To Shareholders In A C Corp Universal Cpa Review

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Irs Expands On Reporting Expenses Used To Obtain Ppp Loan Forgiveness On Form 1120s Schedule M 2 Current Federal Tax Developments

Retained Earnings Formula Calculator Excel Template

/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

Earnings And Profits Computation Case Study

Statement Of Retained Earnings Definition Formula Example Video Lesson Transcript Study Com

Retained Earnings Primer What Is Retained Earnings

Methods To Calculating The Cost Of Retained Earnings Or Common Equity Universal Cpa Review

Statement Of Retained Earnings Example And Explanation Bookstime